- Juerg & Dorothea Beringer

17925 Joseph Drive,

Castro Valley, CA 94546

(510) 581-8655 - John & Janice Friesen

5490 Jensen Road,

Castro Valley, CA 94552

(510) 537-4905 - Paul & Terry Biondi

5215 Seaview Avenue,

Castro Valley, CA 94546

(510) 733-5692

Berkeley

- David Brown & Lowell Brook

400 Vermont Avenue,

Berkeley, CA 94707

(510) 526-4549 - Rachel Roisman & Jason Koenig

2317 – 6th Street,

Berkeley, CA 94710

(510) 622-2573 - Shahla Verrall

145 Poplar Street,

Berkeley, CA 94708

(510) 526-4241 - Helen & Gilbert Newman

2337 – 7th Street,

Berkeley, CA 94710

(510) 898-1647 - Claus & Darian Mahar

31 Avenida Drive,

Berkeley, CA 94708

(510) 547-8662 - Donald Kasarda

69 Sunset Lane,

Berkeley, CA 94708

(510) 525-9344 - Bill & Dara Jordan

978 Overlook Road,

Berkeley, CA 94708

(510) 841-5072 - Lainey Feingold

1524 Scenic Avenue,

Berkeley, CA 94708

(510) 848-8125 - Odile Dupont

845 Grizzly Peak Blvd,

Berkeley, CA 94708

(510) 559-3629 - Jane Wohletz

510 Vicente Avenue,

Berkeley, CA 94707

(510) 526-4107 - Steven Svoboda

706 The Alameda,

Berkeley, CA 94707

(510) 524-3050 - Alan & Jane Schoenfeld

830 Colusa Avenue,

Berkeley, CA 94707

(510) 528-6397 - Warren Peters

150 Brookside,

Berkeley, CA 94707

(510) 428-2786 - Jim & Tilu Maliekal

721 Santa Barbara Road,

Berkeley, CA 94707

(510) 970-5316 - Julie Laws

21 Menlo Place,

Berkeley, CA 94707

(510) 558-8355 - Bill Woods

1236 Neilson Street,

Berkeley, CA 94706

(510) 845-4876 x14 - Peter Shelton

2462 Prince Street,

Berkeley, CA 94705

(510) 666-0778 - Tim Shaw

2802 College Avenue,

Berkeley, CA 94705

(510) 704-0810 - Thomas & Madeleine Shearer

267 Hillcrest Road,

Berkeley, CA 94705

(510) 655-6061 - Alan Hobesh

2738 Forest Avenue,

Berkeley, CA 94705

(510) 558-6907 - Jackie Bott

2312 Oregon,

Berkeley, CA 94705

(510) 649-1996 - Stephen & Millicent Jones

2028 Parker Street,

Berkeley, CA 94704

(510) 548-8110 - Kris & Billy Witort

1643 Allston Way,

Berkeley, CA 94703

(510) 557-4537 - Eric Strellis & Barbara Banks

1518 Grant Street,

Berkeley, CA 94703

(510) 548-8408 - Leonard & Trudy Fellman

1332 Cornell Avenue,

Berkeley, CA 94702

(510) 528-1122 - Fritz Kahrl & Wendy Tao

1225 Allston Way,

Berkeley, CA 94702

510-725-2316 - Robert Gable

2738 Fulton Street,

Berkeley, CA 94705

510-849-8717 - Christel Dillbohner & Gero Leson

440 Michigan Avenue,

Berkeley, CA 94707

510-525-9560 - Christine Everett & Wendy Colombo

2222 Blake Street,

Berkeley, CA 94704

408-472-2871 - Sarah & Todd Patrick

1739 Derby Street,

Berkeley, CA 94709

415-378-7807 - Grant & Katherine Thompson

1578 Scenic Avenue,

Berkeley, CA 94708

510-685-2289 - Eric & Nora Payne

2904 MLK Jr Way,

Berkeley, CA 94703

415-254-9934 - Scott Sparling, P.E.

937 Dwight Way,

Berkeley, CA 94710

510-703-4774 - Caryn Rybczinski

1412 Martin Luther King Jr. Way,

Berkeley, CA 97409

(510) 428-1306 - Ednah Beth Friedman

1205 Spruce Street,

Berkeley, CA 97409

(510) 526-2308 - Virginia Gray

733 Keeler Avenue,

Berkeley, CA 97408

(510) 527-4915 - Peter Lipow

938 The Alameda,

Berkeley, CA 94707

(510) 525-0668 - Dennis & Sharon Darrow

774 Spruce Street,

Berkeley, CA 94707

(510) 559-9941 - Jean Cacicedo & David Leach

1842 San Antonio,

Berkeley, CA 94707

(510) 527-6381 - Nicole Geiger

1197 Sutter Street,

Berkeley, CA 94707

(510) 526-4406 - Scott & Kara Cosby

3043 Halcyon Court,

Berkeley, CA 94705

(510) 845-5673 - Thomas & Anjeannette Schnetz

2945 Ashby Avenue,

Berkeley, CA 94705

(510) 644-2092 - David Soloff

2716 Stuart Street,

Berkeley, CA 94705

(510) 845-1620 - Nancy Ward

2210 Derby Street,

Berkeley, CA 94705

(510) 841-1672 - Monica Bosson

2820 California,

Berkeley, CA 94703

(510) 540-5139 - Simon Labov

1624 Harmon Street,

Berkeley, CA 94703

(510) 652-2189 - Timothy & Susan Allison-Hatch

1611 Rose Street,

Berkeley, CA 94703

(510) 525-7394 - Eric Wells

1514 Virginia Street,

Berkeley, CA 94703

(510) 704-1894 - Lyssa & Dave Mudd

2230 Browning,

Berkeley, CA 94702

(510) 848-7325 - Micah & Michelle Liedecker

1529 Sacramento Street,

Berkeley, CA 94702

(510) 524-5949 - Jeff Wilcox & Nicole Parizeau

1474 Rose Street,

Berkeley, CA 94702

(510) 525-2056 - Sam DeSollar

1440 Delaware Street,

Berkeley, CA 94702

(510) 549-2096 - Jennifer Little TJ Fowler

1410 Peralta Avenue,

Berkeley, CA 94702

(510) 558-7412

Alameda

Phil Chang & Alison Nagahisa

3251 Liberty Avenue,

Alameda, CA 94501

(510) 521-4665

Bob & Beth Van Ausdle

3283 Garfield,

Alameda, CA 94501

(510) 521-8551

Gerald & Noel Robbins

2931 Northwood Drive,

Alameda, CA 94501

(510) 523-6055

Albany

Chantal Rolfing

738 Talbot Avenue,

Albany, CA 94706

(510) 559-9533

Jeff Pilar

915 Talbot Street,

Albany, CA 94706

(510) 525-3250

Doug Johnson

509 Cornell Avenue,

Albany, CA 94706

(510) 558-8466

In Quake-Prone California, Alarm at Scant Insurance Coverage

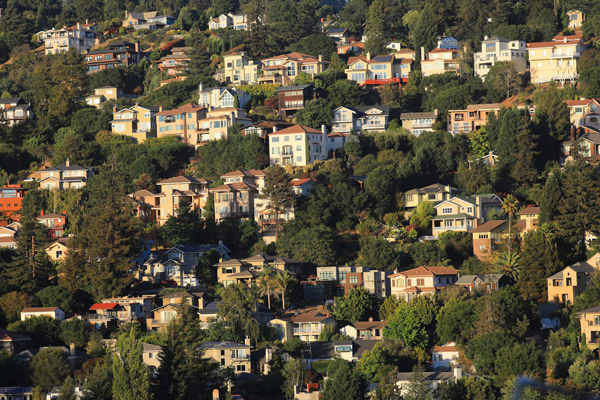

Homes in Oakland, Calif., on the Hayward Fault. Only 13 percent of homeowners in the state have earthquake insurance. Credit Jim Wilson/The New York Times

By Thomas Fuller

Aug. 31, 2018

SAN FRANCISCO — The ravages of wildfires in California have kept Dave Jones, the state’s insurance commissioner, very busy over the past year. But that’s not what keeps him up at night.

“I go to sleep praying that there’s not going to be an earthquake the next day in California,” said Mr. Jones, who has been commissioner for the past eight years. “From an insurance perspective, Californians are simply not prepared.”

Despite an aggressive advertising campaign by the state to promote earthquake insurance, only 13 percent of homeowners have it. And fewer than one out of 10 commercial buildings, which include everything from low-rise office buildings to the high-rise office towers of Los Angeles and San Francisco, are insured for earthquakes, according to the California Department of Insurance.

“Most new buildings are not buying it all,” said Justin Dove, the area vice president in San Francisco for Arthur J. Gallagher, a large insurance broker. Some companies are self-insured, he said, but many find earthquake insurance too expensive.

California, with its multiple geological faults, has benefited from a period of seismic quiet over the past two decades — the last major earthquake struck Los Angeles in 1994 — but a small earthquake that shook parts of Los Angeles County earlier this week was a reminder of the state’s seismic vulnerability. A big earthquake is a certainty for the state, scientists say.

“What are we going to do when no one has insurance and everyone has damage?” said Mary Comerio, an earthquake expert at the University of California, Berkeley. “I’m terrified of what’s going to happen.”

Other states prone to natural disasters have much higher insurance rates. In Florida, where banks typically require homeowners to purchase hurricane windstorm coverage, about 70 percent of households have it, according to ImageCat, a company specializing in disaster risks.

In California, earthquake insurance is not included in standard homeowner policies, and few banks require homeowners to buy it. Alex Kaplan, a disaster specialist at Swiss Re, the insurance company, calls earthquakes the “largest uninsured exposure from a natural disaster in the U.S.”

Employees of Quake Busters, a firm that specializes in residential earthquake retrofitting, install a column at a home in Piedmont, Calif. Credit Jim Wilson/The New York Times

A magnitude 7 earthquake on the Hayward fault, which runs through major cities like Oakland and Berkeley, would displace more than 400,000 people from their homes — the equivalent of about half the population of San Francisco — according to a recent simulation by the U.S. Geological Survey. With California already suffering a severe housing shortage, many people who would lose their homes could be forced to leave the area after an earthquake, whether they have insurance or not, Ms. Johnson said.

The scale of economic losses from an earthquake would of course depend in large part on whether it struck near a large metropolitan area. Estimates of total damages for an earthquake in the Los Angeles area dwarf the costs of any previous natural disasters in the United States.

CoreLogic, a real estate research company, estimated that a 7.3 magnitude earthquake along the Puente Hills Fault in Los Angeles would cause economic losses of as much as $450 billion, more than twice as much as the damage caused by Hurricane Katrina, the costliest United States natural disaster to date.

The main source of earthquake insurance in California is a nonprofit, publicly managed organization known as the California Earthquake Authority, founded two decades ago in the wake of the Northridge earthquake. Shocked by the nearly $17 billion in payouts they made in that earthquake, insurance companies balked at offering further earthquake policies, forcing the state to step in and establish the earthquake authority.

The seismic lull in California since Northridge has helped the authority accumulate $15 billion in available funds for an eventual payout. But its earthquake policies are expensive, and awareness remains low among California residents, experts say.

Mr. Jones, the insurance commissioner, describes the low uptake of insurance as “a chronic problem of denial and underestimation of the risk.”

In the case of a large earthquake would the state or federal government come to the rescue?

Mr. Jones says no.

Many Californians, he said, “mistakenly believe that FEMA or the state will rebuild their homes in the event of an earthquake.”

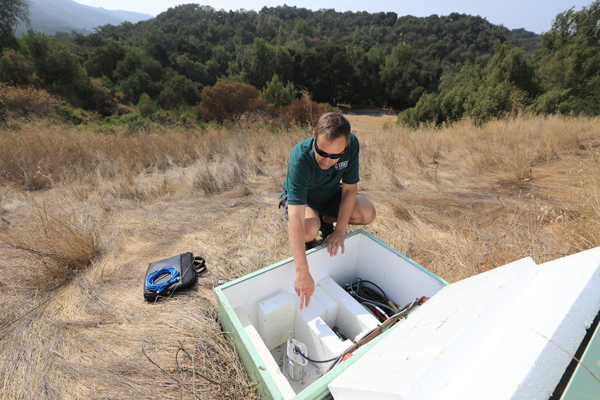

Dave Croker, a program manager for the U.S. Geological Survey, at a remote site in the San Antonio Open Space Preserve, where the agency maintains one of several hundred remote seismology sensing stations in Northern California. Credit sJim Wilson/The New York Times

FEMA, the Federal Emergency Management Agency, has a ceiling on individual assistance in disasters of $33,000, but actual payouts are typically much lower.

“If you have a $1.45 million home in San Francisco, that $33,000 is not going to get you very far,” said Mr. Kaplan of Swiss Re.

Evan Reis, an engineer who is the executive director of the U.S. Resiliency Council, a nonprofit organization founded to promote the construction of buildings more resistant to earthquakes, finds it odd that flood insurance is required by banks in flood zones, but that earthquake insurance is not required in coastal California.

“In the Bay Area, 90 percent of the properties are not insured,” he said. “How many hundreds of billions of dollars is that in potential uninsured losses? it’s astounding when you think of it.”

Last year, the share of California households with earthquake insurance rose to 13 percent, from 11 percent the previous year.

Glenn Pomeroy, chief executive of the California Earthquake Authority, attributes the uptick partly to the public seeing reports about disasters like the Northern California wildfires last October, as well as Hurricane Harvey and earthquakes in Mexico.

Several years ago, the earthquake authority ran ads showing happy Californians enjoying the beach or walking through a Sierra forest, with an upbeat narrator suggesting that viewers consider earthquake insurance because “California rocks.”

“We overdid it in terms of not scaring people,” Mr. Pomeroy said.

The authority plans to spend $12 million on advertising in 2019, more than double its spending at the beginning of the decade. Its latest campaign, “It could happen today,” uses suspenseful music and darkened scenes of California waking to uncertainty.

“Will today be like any other?” intones a worried voice. “Or a day that turns our world upside down?”

Read full article here: https://www.nytimes.com/2018/08/31/us/california-earthquake-insurance.html

On the News

Earthquake Exhibit at Academy of Science – Golden Gate Park

Don’t miss Earthquake, a major new exhibit and planetarium show exploring the seismic science that has shaped Earth’s evolution and continues to impact our lives today.

For more information, please visit: https://www.calacademy.org/academy/exhibits/earthquake/index.php?dc=